A word from our Chairman

At Thor, we look for growth opportunities and leverage on those tailwinds to support our investments and work diligently to deliver returns to our investors. Our strategy is driven by macro-economic and geopolitical themes and trends. As those change, we adjust.

Welcome

Thor Equities Group is a leader in the management of industrial, life science, creative and tech office, residential, hotel, and mixed-use assets in premier urban locations worldwide.

- $20BAssets Under Management

- 160+Investments

- 50MReal Estate Square Foot Pipeline

Investing with us

With professionals in five countries, Thor’s investors benefit from in-depth Global Experience and expertise in strategic locations globally. Thor maximizes returns for institutional investors through a strategic vertically integrated platform and value-add execution.

Our values

Thor is committed to investing responsibly and empowering our teams across the world. We believe in creating a diverse, equitable, and inclusive workplace where we can inspire innovation and make a positive impact to benefit our employees and communities. We prioritize environmental, social, and governance factors across our portfolio and are devoted to maintaining the highest sustainability practices and reducing our environmental impact.

Knowledge

34 year track record

Over the past three decades, Thor Equities has emerged as an industry leader with divisions spread across three continents by experts across all asset classes:

Insights and thought leadership

Explore Thor news, press mentions and releases, as well as videos, webinars, and speaking engagements.

Partners

Thor is a trusted partner, developer, and landlord to premier companies worldwide. We take pride in delivering state-of-the-art space to world-class companies for their global headquarters, flagships, distribution centers, and more.

Amazon

Valentino

Celgene - Bristol Meyers Squibb

DHL

Samsung

Nestle Health Sciences

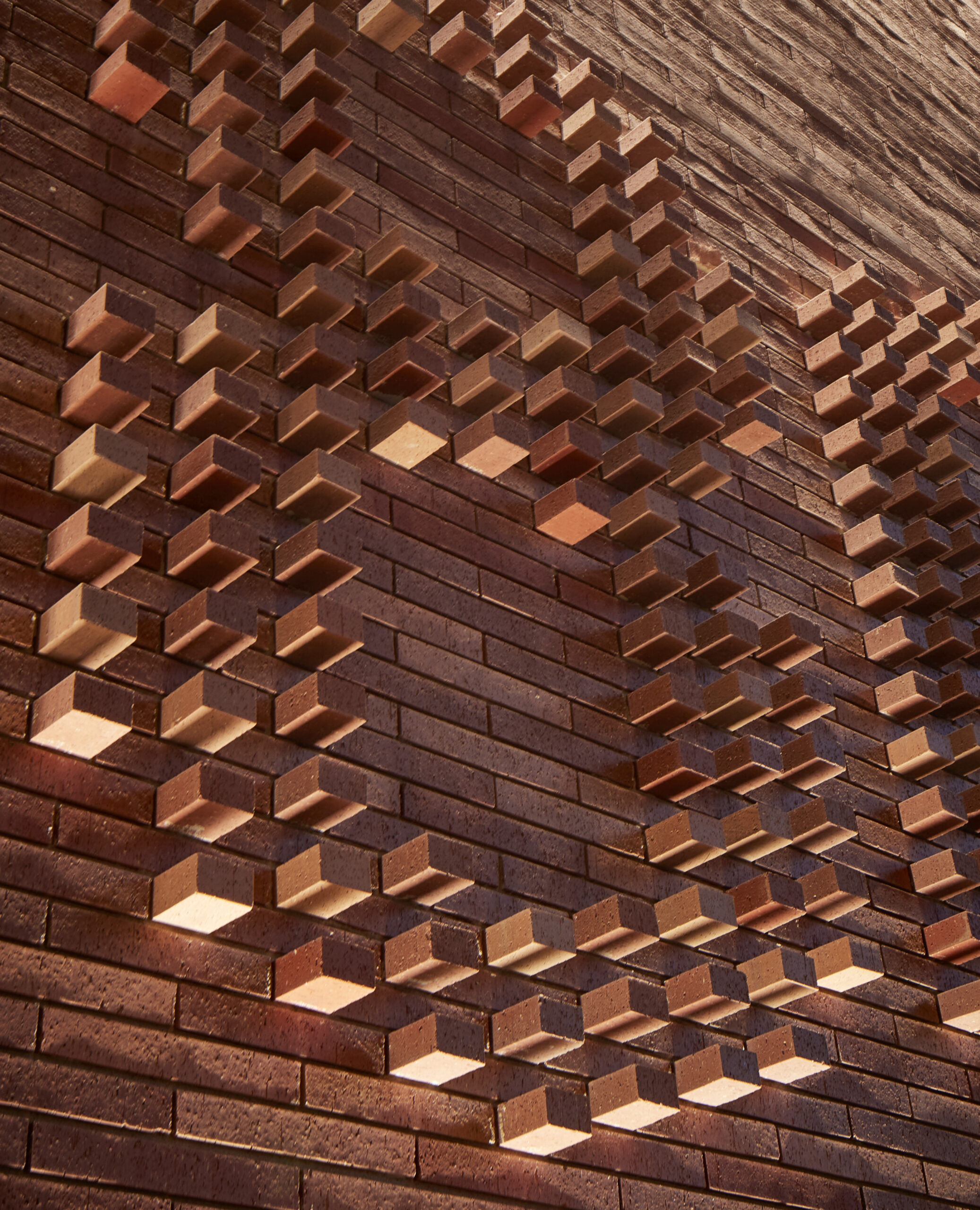

Center of Excellence, Bridgewater, New Jersey

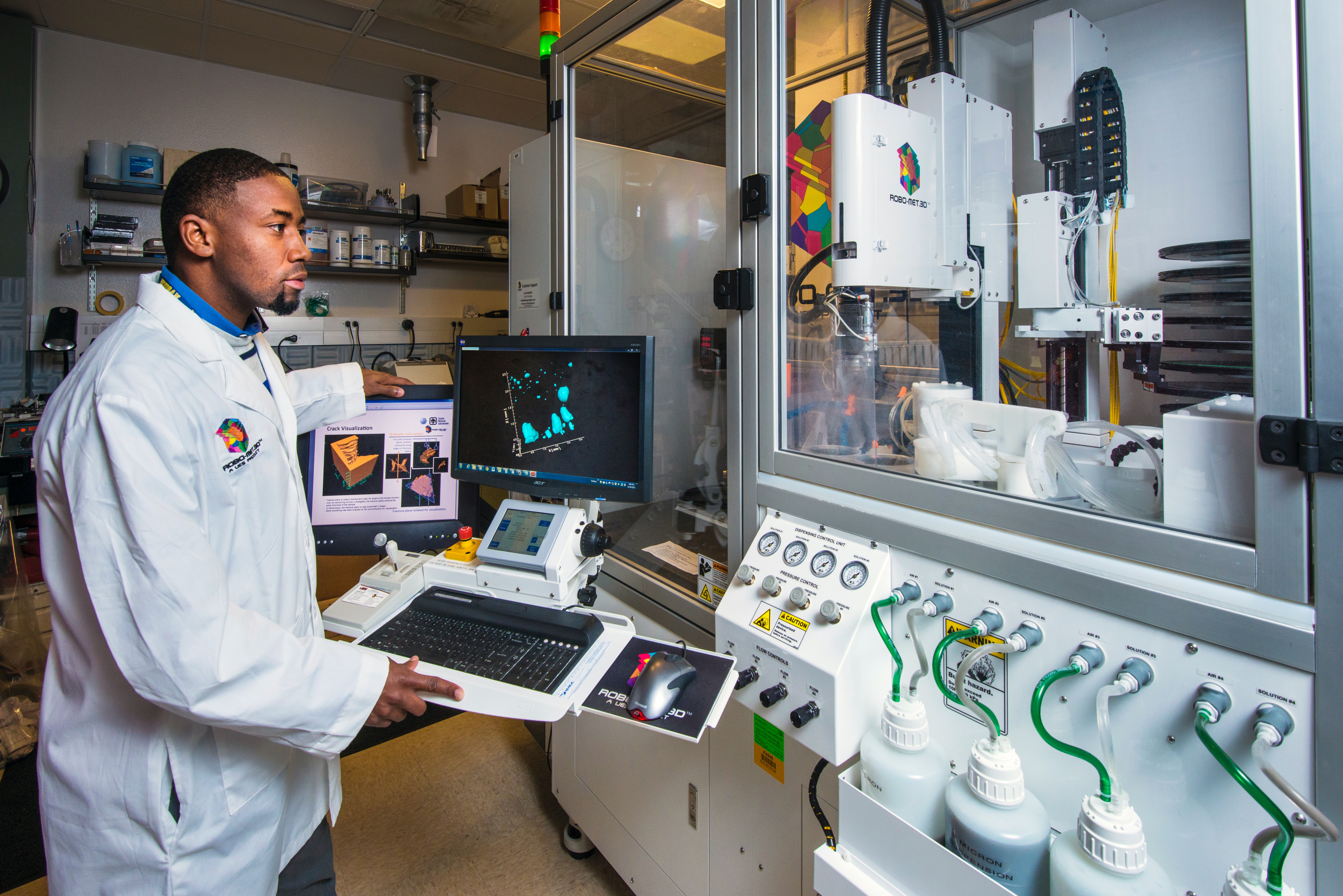

Life SciencesAbout

Thor Equities deployed its expertise in acquisitions, development, leasing and hands-on operating qualifications to reposition the Center of Excellence to a core life science asset. Thor improved building features and amenities to bring the property to full occupancy within months of acquisition and counts Nestle Health & Science, PTC Therapeutics, Amneal Pharmaceuticals, and more premier companies as tenants.

Key Facts

- 783,500 square feet

- 48 acres

- 7 interconnected buildings

- Centralized Utility Plant

Tudor Portfolio, United Kingdom

LogisticsAbout

Acquired in December 2019 and sold in January 2021, the Tudor Portfolio consists of seven warehouses in London and the Golden Triangle. Thor consistently uses its vast network to identify off-market opportunities and was able to acquire this property at an ideal time and sell it months later at the height of the market.

Key Facts

- 139.5% levered IRR

- 7 high quality assets

- 2.2m square feet

Thor in the News

Joe Sitt, Chairman and CEO of Thor Equities, spoke with CNBC’s Squawk on the Street team to discuss the booming data center market, voracious appetite for new technology, interest from investors, and more on the evolving commercial real estate landscape.